Stock markets have taken a beating in recent weeks and they look set for more volatility ahead as governments and central banks grapple with the Covid-19 outbreak.

The downturn has sparked anxiety, especially among relatively new investors, who had been riding high on continued market returns and growth over recent years.

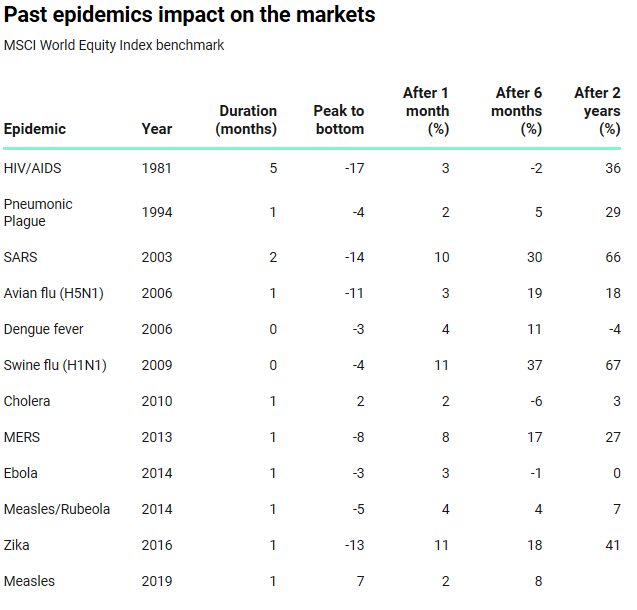

However, it is vital to remember that this is not the first — and won’t be the last — market dip, and it can be good opportunity to assess and check your investment strategy. Let’s look at the table below which shows the impact of the Covid-19 outbreak in context against other similar past pandemics.

You will see that usually, following extreme volatility, markets react extremely well in the year or two afterwards giving periods of strong returns and growth once confidence and certainty returns to the markets.

When looking for opportunities in uncertain times, it is important to remember the core investing strategies: go gradual and diversify, diversify, diversify.

Market volatility is something that investors should be prepared for, despite the recent volatility being quite extreme. Start small and ensure you are diversified across major asset classes (equities, bonds, gilts, cash, property and commodities) and major regions and sectors.

At Milestone we educate and help our clients develop an investment strategy based on four key principles;

1. Invest for the long-term — Make sure you have three-to-six months’ salary saved in cash for a rainy day, because any money you invest in the market should be locked away for long-term goals.

2. Contribute gradually — Invest a fixed sum regularly into the same investment product over a long-term period. This allows you to buy more units when the cost is low, and less when the price is high. It’s a strategy known as pound-cost averaging.

3. Take advantage of compound growth — Time in the market is more important than timing the market. Earn growth on the growth you receive by sticking to a disciplined investing plan.

4. Lastly, but most importantly – Diversify, diversify, diversify — Consider low-cost, passively-managed funds, which give you exposure to a broad range of assets and sectors.

The current market dip can provide an especially good opportunity for young investors who have a long timeline to play with. People who invest consistently during corrections and when markets brake tend to perform even better than those who withdraw during corrections and do nothing during break-even periods.

Those who already have a stake in the market should hold tight. Times like these stress test not just the market, but individuals too … Try not to be swayed by your emotions. Unless you have an immediate need for cash, do not sell your assets out of panic.

While financial experts expect the downturn to continue in the near term, most agreed that markets will recover over the next few months. History has shown that the markets bounce back time and time again. The underlying economic indicators in the U.S. and China are strong, and recent events are likely to delay but not derail that growth.

China, in particular, has shown positive signs of recovery, having recorded a drop-off in new virus cases over recent days. Meanwhile governments elsewhere, including in the U.K have implemented proactive fiscal measures to support their economies.

If you are concerned about the recent market volatility or don’t know if your investments are diversified well enough, get in touch for a free financial review.

Top Rated Financial Advisors