UK Inheritance Tax Planning for Small Business Owners

The realm of inheritance tax planning is daunting for many small business owners in the UK. The tax implications, if not handled properly, can leave your heirs with a hefty inheritance tax (IHT) bill.

Thus, planning for these eventualities is crucial. This guide provides an in-depth look into the subject, offering practical advice to help you navigate the complexities of inheritance tax planning.

Understanding Inheritance Tax (IHT)

Inheritance tax is a charge levied on an individual’s estate (property, money, and possessions) when they pass away. It’s also applicable to some gifts made during the person’s lifetime.

Generally speaking, the current IHT rate is 40% on anything above the tax-free threshold of £325,000. However, it’s worth noting that the rate may be reduced to 36% if 10% or more of the estate is left to charitable donations.

There are other tax free allowances which are mentioned below and for those owning a business, the taxation landscape differs significantly.

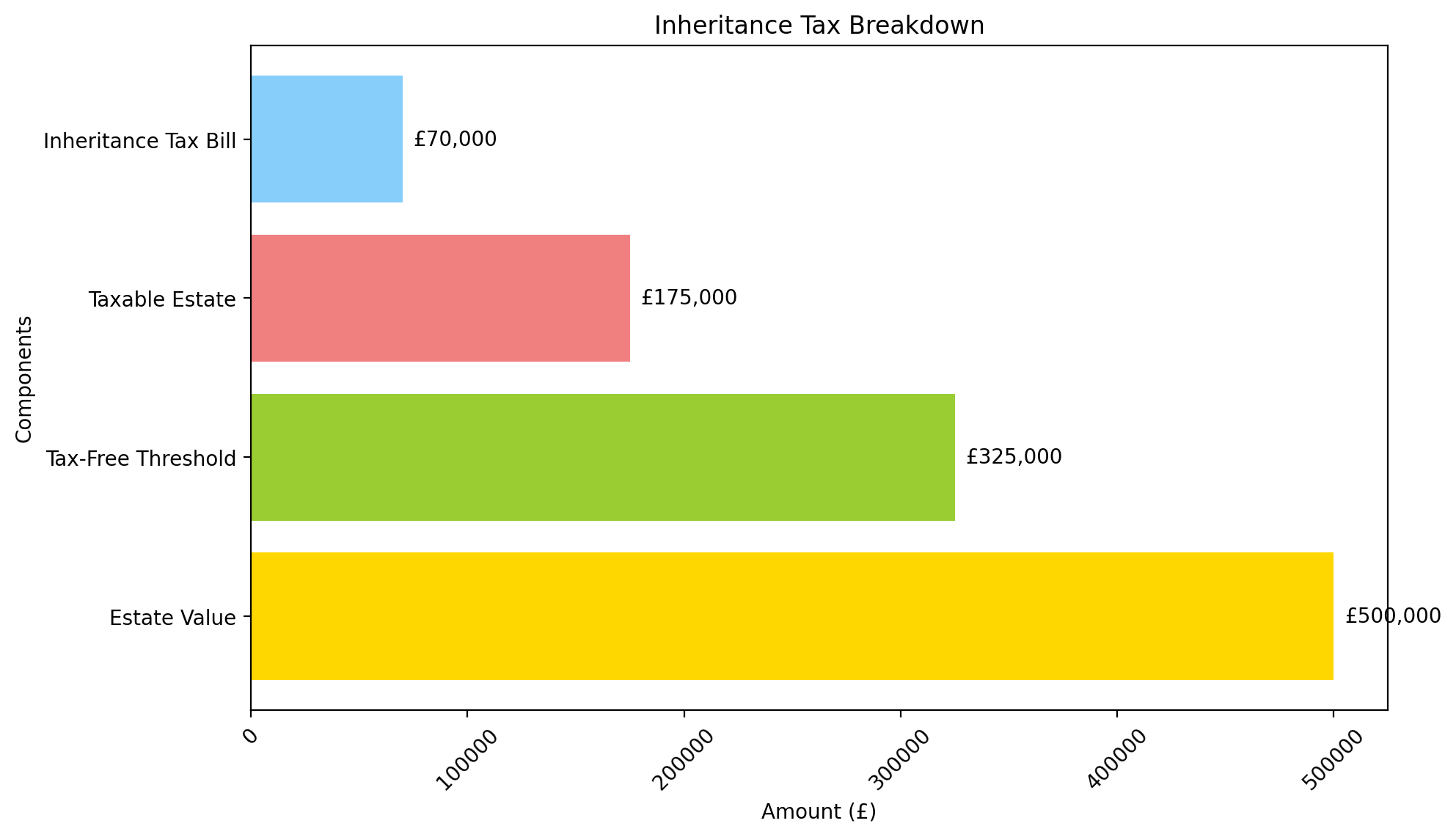

Example:

Estate value: £500,000

Tax-free threshold: £325,000

Taxable estate: £500,000 – £325,000 = £175,000

Inheritance tax bill: £175,000 * 40% = £70,000

However, for those owning a business, the taxation landscape differs significantly.

Business Relief (BR), formally known as Business Property Relief (BPR)

Business Relief, formerly known as Business Property Relief, is a tax relief available for business property. It was designed to facilitate the transfer of family businesses across generations without triggering a significant IHT bill.

The relief can be 100% or 50%, contingent on certain qualifying conditions. Notably, there’s no cap on the value of BPR that can be claimed.

100% BR

For 100% relief, the business assets must have been owned for at least two years. This rule applies to a sole trader’s business, partnership interests, and shares in trading companies not listed on a recognised stock exchange.

Shares in companies listed on the Alternative Investment Market are also typically eligible for 100% BR.

50% BR

A 50% relief rate applies to land, buildings, machinery, and plant used for business purposes. These assets must have been owned and primarily used for business within the last two years. The 50% rate also applies to shares in listed companies where the shareholder has a controlling interest (over 50%).

BR Exclusions

Certain businesses and assets do not qualify for BR. These include investment companies, businesses dealing in shares, stocks, securities, land or buildings, and companies under a binding contract for sale or being wound up.

Vital Considerations for IHT Planning

When planning for IHT, several factors come into play, particularly for family-run businesses. Here are some key points to consider:

Transfers between Spouses or Civil Partners

If a business asset qualifies for BR, transferring it to a spouse or civil partner won’t provide any IHT savings. That’s because transfers between spouses or civil partners are usually exempt from IHT.

Using the Annual Tax-free Allowance

Even if shares don’t qualify for BR, an individual can utilise the £3,000 annual tax-free allowance for IHT.

This allowance permits the shareholder to pass shares to anyone they choose, potentially increasing the beneficiary’s interest in the company over time and reducing the IHT payable on the donor’s death.

Contractual Agreements

No BR is available where there’s a binding contract for the sale of the business. For instance, a shareholders’ agreement might stipulate that if one shareholder dies, their executors must sell their holding to the remaining shareholders.

Exit Strategies

Another option is to sell or wind up the business rather than leave it to beneficiaries. This strategy guarantees a fixed value available in cash.

However, cash doesn’t qualify for BR, making this tactic somewhat disadvantageous.

BR and Trusts

In some cases, it might be beneficial to leave business assets to a trust rather than a spouse or civil partner.

Trusts are useful legal constructs that can provide a more controlled environment for managing assets and reducing the value of the estate for IHT purposes.

Case Study: IHT Planning in Action

Consider Sally and Graham, a married couple. Sally owns 80% of the shares in a fashion company valued at £3m.

They also own a house and savings between them worth £1.5m, making their total joint estate worth £4.5m.

If Sally had left her company shares to a discretionary trust in her Will, instead of to Graham, the potential IHT saving would be significant.

Since Sally’s shares in the trading business qualified for BPR, no IHT would be payable upon her death. Then, when Graham died, his estate wouldn’t include the value of the shares, resulting in a much lower IHT bill.

This scenario illustrates the power of professional advice in the subject to IHT and planning and the potential savings that can be achieved.

Other IHT Planning Strategies

Lifetime Gifts

Gifts made during one’s lifetime are immediately exempt from IHT if they fall within the Annual Allowance (£3,000 per annum) or Small Gift (£250 per annum) exemptions.

Gifts exceeding these amounts may still be exempt if the donor survives for seven years after the date of the gift.

Trusts and Family Investment Companies

Establishing a trust or Family Investment Company can help remove wealth (and future growth) from one’s estate, while still maintaining control over the assets.

These structures also offer an element of asset protection in the event of a failed business or relationship breakdown.

Pension Pot Considerations

Pensions can serve as a valuable tool for passing on wealth. For those with assets both inside and outside a pension plan, it’s worth considering if it might be better to use non-pension assets rather than drawdown from their pension.

Making a Will

Making a Will is crucial to ensure that part of your estate is distributed according to your wishes. Without a Will, your estate will be divided under the intestacy rules, which could result in unnecessary IHT.

IHT-Efficient Investments

Investing in certain assets, like AIM shares and farmland, can attract 100% relief within a relatively short period, usually after 2 years. However, such investments carry inherent risks, so professional advice should be sought before investing.

Insurance

Life insurance policies won’t reduce the amount of IHT due on your estate, but the payout can make it easier for your family to pay the bill and possibly prevent the family home from being sold.

The Importance of Professional Advice

Given the complex nature of IHT planning and the potential for significant financial implications, consulting with a professional adviser is crucial.

Such advice can help you make informed decisions, optimise your tax planning, and ensure the survival and continuity of your business after your death.

Inheritance tax FAQs

Inheritance Tax When the Second Parent Dies UK

When the second parent dies in the UK, inheritance tax may be due on their estate. The good news is that any unused inheritance tax threshold from the first parent can be transferred, effectively doubling the tax-free amount for the surviving spouse or civil partner.

BR may apply to certain assets, reducing the family member overall inheritance tax liability.

Inheritance Tax Threshold

The inheritance tax threshold in the UK is £325,000 per person. If you’re a business owner, certain assets may qualify for BPR, which can reduce the value of your estate for inheritance tax purposes.

It’s essential to undertake inheritance tax planning to make the most of available reliefs and exemptions, such as the residence nil-rate band.

What is the 7-Year Rule in Inheritance Tax?

The 7-year rule in inheritance tax refers to gifts made during a person’s lifetime that may be exempt from paying inheritance tax if the person lives for at least seven years after making the gift.

This is particularly relevant for many business owners who may want to transfer business assets or shares in a family-owned trading company.

If the person dies within seven years, a sliding scale of tax rates applies, which can be reduced if the person dealing with the gift qualifies for business relief.

Can I Give My House to My child to Avoid Inheritance Tax?

Yes, you can give your house to your child to potentially avoid inheritance tax, but you must survive for at least seven years after the transfer for it to be fully exempt.

This is known as the 7-year rule. However, you should seek professional advice from a financial adviser, as this move could have other tax implications, such as capital gains tax.

Also, if you continue to live in the property without paying market value rent, it may still be subject to inheritance tax under the ‘gift with reservation of benefit’ and inheritance tax rules.

There is an additional allowance under IHT exemption rules which is the Residence nil rate band (RNRB), this is currently £175,000 and applies when a deceased’s main home is being left to direct descendants.

This effectively increases the IHT tax free allowances of an estate to £500,000. Similar to the IHT nil rate band, the residence nil rate band can be passed to a surviving spouse or civil partner if unused on death.

Inheritance tax the Bottom Line

Inheritance tax can take a significant portion out of your estate, reducing the amount you can pass on to your loved ones. However, with careful planning and an inheritance tax plan and utilisation of reliefs like BR, it’s possible to minimise this the inheritance tax bill and burden.

Remember, tax rules are complex and subject to change, and the benefits of different strategies will depend on your individual circumstances. It’s always a good idea to seek professional advice when planning your estate.

With proper understanding and planning, you can ensure your hard-earned assets are passed down to future generations with minimal tax implications.

UK Inheritance Tax Planning Conclusion

In summary, inheritance tax planning for small business owners involves a delicate balancing act. It requires careful consideration of various factors, including BR, trusts, lifetime gifts, and more.

By seeking professional advice and planning ahead, you can protect your business assets, safeguard your beneficiaries, and minimise your inheritance tax liability.

Disclaimer:

Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax or trust advice. The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Top Rated Financial Advisors