Calculating Inflation UK: Your Complete Guide to Understanding Price Changes

How does the UK calculate inflation? Calculating inflation leans on indices like the Consumer Prices Index (CPI), Retail Price Index (RPI), and Consumer Prices Index, including owner occupiers’ housing costs (CPIH), overseen by the Office for National Statistics (ONS).

This guide cuts through the complexity, outlining how these measurements are measured and derived and offering insights.

Key Takeaways

- The UK measures inflation with several indices: CPI, RPI, and CPIH, each with distinct characteristics and uses to reflect the average prices of goods and services.

- The Office for National Statistics (ONS) publishes monthly inflation data and ensures its quality through adherence to European Statistical System quality dimensions, with plans to align RPI with CPIH by 2030.

- Inflation indices rely on a ‘shopping basket’ of goods and services, which is reviewed annually to represent household spending; the weights of categories within the basket are also periodically revised to match consumer spending changes.

Deciphering the UK Inflation Calculation

Inflation, though seemingly abstract, is anchored in distinct calculations involving various consumer behaviours and economic conditions. In the United Kingdom, several indices to measure inflation as mentioned previously, including the CPI, the RPI, and the CPIH.

These price indices, such as the retail price index, are not just strings of acronyms; they are crucial gauges reflecting the average price changes of goods and services purchased by households.

Each of these indices has its unique characteristics:

- The CPI, which aligns with European standards, is central to the government’s inflation target.

- RPI, despite having been deemed as not meeting the standard for National Statistics, is still utilised for long-term contracts and index-linked gilts in the UK.

- The CPIH, which includes expenses related to housing, is recognised as the most comprehensive measure of UK inflation.

These measures are annually updated to maintain their relevance to current consumer spending behaviours and economic circumstances in the past year.

The Role of the Office for National Statistics

The Office for National Statistics (ONS) is at the helm of those responsible for publishing inflation data. This office has the responsibility of publishing inflation data, including CPIH, CPI, and RPI in its monthly Consumer Price Inflation statistical bulletins, which significantly impact the UK’s economic performance assessments.

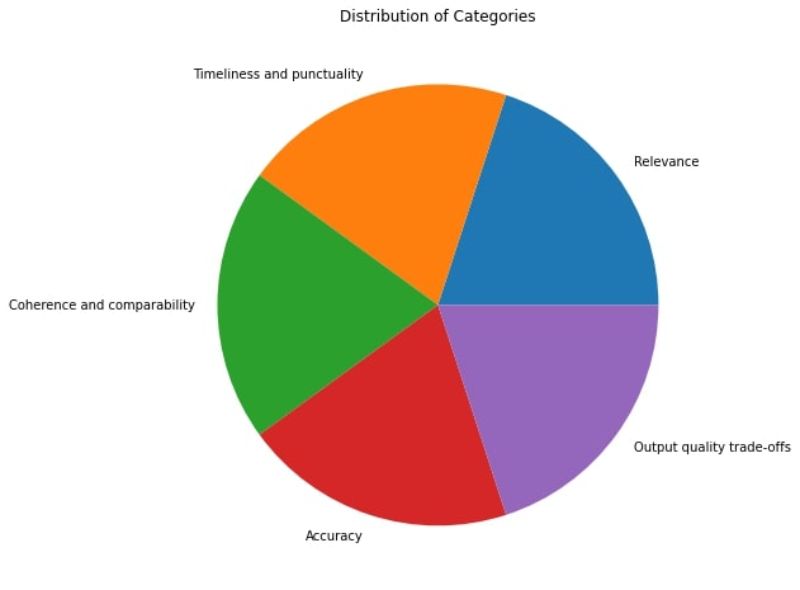

Beyond just publishing data, the ONS is also tasked with assuring its quality. The ONS adheres to five European Statistical System (ESS) quality dimensions in measuring statistical quality:

With a future-oriented approach, the ONS plans to revise inflation measurement methodologies, aiming to align RPI with the CPIH methodology by February 2030. Such changes can substantially affect the financial landscape for savers, investors, and pensions.

In line with its commitment to punctuality, the ONS maintains a practice of advance notice for the publication dates of inflation data, ensuring timeliness and punctuality. Visit the ONS Inflation and price indices here!

Understanding Various Inflation Measures

You may have observed frequent mentions of the terms CPI, CPIH, and RPI thus far. These are the three main measures of inflation in the UK, but what exactly are they? The CPI was adapted from the Harmonised Index of Consumer Prices and became the UK inflation target in December 2003.

The CPIH was introduced later, in 2013, with the unique feature of including owner-occupiers’ housing costs. While CPI and CPIH include expenditures of all private households and foreign visitors, the RPI does not include the highest income and certain pensioner households. The key differentiators when comparing RPI to CPI and CPIH are:

- The presence of mortgage interest payments in RPI

- Exclusion of certain households in its calculation

- An older formula potentially overestimates inflation.

These differences have prompted moves towards aligning RPI with CPIH methodology. Interestingly, CPIH is considered an experimental measure partially due to its calculation, which assumes a uniform price change experience across all households and uses both plutocratic and democratic weighting in its methodology. This highlights the importance of understanding different measures and their implications.

The Inflation Calculator: A Handy Tool

How can an average individual or professional decipher these indices and measures? This is where the inflation calculator page comes into play. This handy tool helps estimate the average inflation rate over specific periods, allowing users to:

- Compare the value of their money across different years!

- Access official and estimated CPI data

- Use a user-friendly interface to understand inflation

This tool proves especially useful for comprehending the impact of inflation on personal financial matters, including loans and savings.

It enables users to track how inflation has eroded or indeed grown the buying power of their money over the years. It’s also a great way to prepare for future changes, especially with evolving methodologies, like the upcoming changes to RPI.

The Building Blocks of Inflation Indices

Grasping inflation calculations also requires an understanding of the ‘shopping basket’ concept of goods and services used in these calculations. This basket is more than just a metaphor; it is a carefully curated collection of goods and services that represents the spending habits of households across the UK.

The items in the basket are not just randomly thrown together; they are selected and reviewed annually to ensure they reflect current consumer spending patterns. By dynamically adjusting this basket, the ONS ensures that the inflation data reflects the shifting economic landscape and consumer behaviours.

Composition of the Price Index Basket

The contents of this ‘shopping basket’ are determined based on several criteria, including ease of pricing, constant availability, consumer expenditure patterns, price variability, and a balance across different categories.

The ONS ensures that the basket is representative by annually reviewing and updating its contents. This is done through information from price collectors, market research, surveys, and chain linking new and old items at the start of each year.

For instance, the updates to the CPIH basket in 2022 and 2023 reflected consumer trends, with additions like meat-free sausages and removals of less relevant items. While CPIH and CPI are similar, CPIH includes costs like owner occupiers’ housing and Council Tax, providing a broader measure of inflation than RPI, which has been criticised for its methodology.

Weighing the Cost of Living

The ‘shopping basket’ concept isn’t solely about the included items; it’s also about the weight assigned to each category within the basket. CPIH, for example, uses rental equivalence to estimate owner-occupiers’ housing costs by determining how much it would cost to rent an equivalent property. Housing costs in CPIH are weighted significantly, representing 16.5% of the expenditure weight, highlighting the sector’s impact on households’ spending power.

The weights of different categories in CPIH are periodically revised to reflect changes in consumer spending patterns. For instance, there have been noteworthy weight adjustments in CPIH categories such as transport and restaurants due to shifts in consumer spending during the COVID-19 pandemic.

The Mechanics of Measuring Price Movements

The ‘shopping basket’ concept is vital for consistently measuring price movements. Maintaining a consistent ‘shopping basket’ is key to reflecting precise price movements, thus yielding reliable inflation data. To guarantee valid comparisons, the items in this basket are unchanged for the duration of each calendar year.

This fixed-basket approach ensures that the observed month-to-month changes are attributed solely to price fluctuations and not to changes in the quality or quantity of the goods and services. By referring to the following table, this approach provides a robust and consistent method for tracking inflation and understanding how prices are changing over time.

Tracking Prices Across the UK

![]()

When it comes to tracking prices, the ONS uses three distinct methods: local collection, central shops, and central collection. These methods are employed across about 150 locations in the UK’s 12 government regions.

Collecting prices across such a wide geographical spread helps ensure that the inflation data accurately reflects the price changes experienced by consumers across the country.

To compile the inflation indices, around 180,000 separate price quotations are collected monthly across approximately 730 representative consumer goods and services. The sheer scale of this data collection process underscores the thoroughness and rigour involved in measuring price changes across the UK.

Get Started Today

Book a Meeting

Wanting to know if you're on track to reach your financial goals? Book an appointment for a financial review today and find out what we can do for you.

Read about our advisors on our about page here.

Calculating the Average Inflation Rate

With all these price data available, how does one calculate the average inflation rate? The ONS calculates base prices and periodically revises weights for CPIH and CPI to reflect changes in consumer spending patterns.

Local probability sampling and regression analysis are utilised for setting a representative sampling frame for pricing certain consumer goods, ensuring an accurate reflection of average prices and market prices.

Interestingly, estimates of the CPIH and CPI typically use a geometric mean to combine individual prices at the first stage of aggregation. This is in contrast to the RPI, which uses arithmetic means and weighted formulae. These different methods of calculation highlight the intricate and varied approaches used to calculate the average inflation rate.

Inflation’s Impact on Economic Indicators

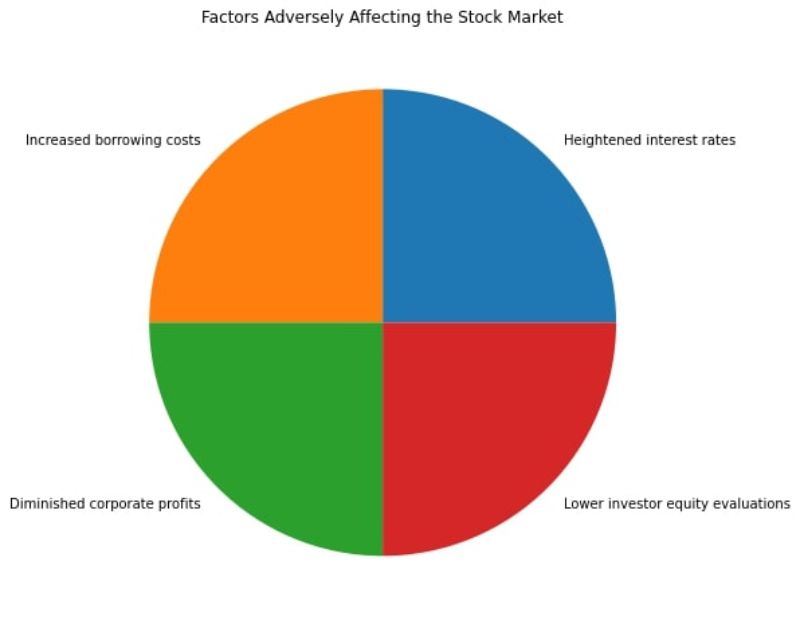

Inflation isn’t isolated; it profoundly impacts a variety of economic indicators. High inflation rates can erode real investment returns, making fixed-income investments such as bonds less appealing to investors. Higher inflation often results in:

These factors can adversely affect the stock market.

To tackle these challenges, the UK government has rolled out financial support measures, including the Energy Price Guarantee, to alleviate the effects of high inflation rates on households. So, whether you’re an investor, a homeowner, or simply a consumer, understanding inflation is vital to navigating the economic landscape.

Inflation and Interest Rates: The Bank of England’s Perspective

The Bank of England holds a crucial role in controlling inflation. It has increased interest rates to manage inflation, with the rate rising from 0.1% in December 2021 to 5.25% in August 2023 through consecutive hikes.

Financial markets and economists anticipate that the Bank of England will not increase interest rates further, based on the projection that inflation will continue to decline and economic growth will remain subdued.

However, the Bank of England has noted an unusually high wage growth rate at 8.0% in the private sector from June to August 2023. This presents a risk that persistently high inflation could result if this further pace of wage growth is not matched by productivity increases.

Adjusting Wages and Salaries: The Cost-of-Living Challenge

Inflation’s influence extends beyond financial markets, having a concrete and significant impact on wages and salaries. High inflation can create a wage-price spiral in the UK, as increasing costs of living prompt demands for higher wages, which results in businesses potentially raising prices further to cover the additional wage costs.

In response to a wage-price spiral, businesses may face pressure to increase prices, affecting their competitive position and potentially leading to even higher inflation rates. To mitigate this impact, businesses can set up spending control mechanisms to reduce consumption and eliminate unjustified costs.

Navigating the Inflation Landscape: Practical Applications

Besides understanding inflation, it’s equally imperative to learn practical ways to navigate the inflation landscape. Individuals can protect themselves from inflation by evaluating their short and long-term financial plans and adjusting them if necessary, such as by deferring large expenditures or finding additional income sources.

During inflationary times, it’s vital to strike a balance between saving and debt repayment to avoid the erosion of savings’ real value, and considering halting the acquisition of new debt can be beneficial.

Budgeting for Inflation: Planning Personal Finances

Effective navigation of the inflation landscape also necessitates intelligent budgeting decisions. For instance, reviewing and reducing energy consumption through an energy audit can safeguard against inflation-related increases in utility bills. Savings on car and homeowners’ insurance can be achieved amidst inflation by raising insurance deductibles, negotiating for discounts, reducing coverage where sensible, or changing providers.

Eliminating non-essential subscriptions and minimising banking fees can contribute to effective budget control in the face of rising costs due to inflation. Smart grocery shopping habits, such as opting for generic brands, buying in bulk, and utilising discount apps, can help keep food costs in check as inflation impacts prices.

Enhancing income by selling unused items, seeking pay raises, pursuing side hustles, or considering job changes is a proactive approach to addressing budget tightness caused by inflation.

Strategic Business Planning: Adapting to Price Changes

Businesses also have a range of strategies at their disposal to adapt to price changes resulting from inflation. They can:

- Adjust their financial forecasts.

- Revise their pricing models to reflect increased costs of goods, services, and production.

- Reassess their price potential and targets, potentially revealing previous under-pricing while considering new price increases.

To manage higher energy prices, companies may pass costs to consumers but should also seek to reduce their own consumption by using efficient practices and equipment. Implementing changes in business operations, like consolidating trips and establishing preferred vendor programs, can mitigate the impact of energy costs on the business budget.

While adjusting to inflation, differentiating revenue channels is essential; businesses should variably adjust prices, raising them more for less-profitable client categories.

Summary

Inflation, as we’ve seen, is a complex but crucial facet of our economic landscape. Understanding how it’s calculated, how it impacts various economic indicators, and how we can navigate its effects is vital for both individuals and businesses.

With this comprehensive guide, we hope you now have a deeper understanding of inflation in the UK and feel more equipped to make informed financial decisions in an inflationary environment.

Frequently Asked Questions

How do you calculate inflation in the UK?

To calculate inflation in the UK, you can measure it by comparing the rise in the cost of goods and services today with their cost a year ago, then calculate the average increase in prices, which is known as the inflation rate.

What is the formula for calculating the inflation rate?

To calculate the inflation rate, use the formula (B – A)/A x 100, where A is the starting number and B is the ending number. No need to use the complex calculation method.

How does the ‘shopping basket’ concept work in measuring inflation?

The ‘shopping basket’ concept measures inflation by using a selection of goods and services that represent household spending habits. This basket is updated annually to reflect current consumer behaviour.

How does inflation impact economic indicators?

Inflation can have a significant impact on economic indicators by eroding real investment returns, increasing interest rates, and potentially leading to a wage-price spiral. It is important to closely monitor and manage inflation to maintain a stable economic environment.

Top Rated Financial Advisors