This year has been a tough one for investors, but it’s crucial to keep perspective. Downturns occur often and are a natural part of the economic cycle. Though volatility can be disconcerting, if you tune out the market noise and stay invested, you’ll be better off in the long run.

Amidst the soaring inflation, rising interest rates, supply chain issues and the war in Ukraine, it has been a difficult year for the markets so far. The FTSE 100 suffered its biggest monthly drop in June since the start of the pandemic, while the S&P 500 had its worst first half in more than 50 years. Stocks in Europe and Asia have also fallen significantly, while a range of other assets have recorded major losses, including bonds.

At the start of the year, investors had to contend with the implications of higher interest rates needed to bring down inflation, which hit growth stocks particularly hard. Then came the Russian invasion of Ukraine, which caused energy prices to increase even further. This fuelled inflation, which caused Central Banks to raise interest rates higher still to try and get rising prices under control. Rate hikes and inflation are anticipated to escalate the global economic slowdown, causing anxiety about a possible economic decline for major economies. Some economists are even suggesting that the US could experience recessionary conditions by the end of the year.

Don’t Listen to your Emotions

Even though market fluctuation is impacting portfolio performance, it’s crucial not to respond by making hasty investment decisions. Market volatility is currently high, and even experienced investors might be considering transferring their funds into lower risk investments.

It is often best to avoid acting based on your emotions – in this case, fear. Relying on your intuition can lead to investment mistakes. If you act quickly, you are more likely to make costly mistakes, like selling when prices are low or buying when they are high.

Furthermore, cognitive biases can lead investors to make decisions based on emotions rather than logic, and these choices can damage portfolios in the long run. For example, loss aversion is the concept that the emotional anguish of losing is more influential than the happiness of gaining. People might be afraid to invest because they are afraid of what they might lose. This can make people unsure of when to invest, what stocks they should choose, and how long to wait for market changes. People might also hold onto a stock that is not doing well in the hopes that it will recover. When you see the value of your investments suffering from volatility it can be tempting to take action but giving in to fear or your gut can cost you dearly. Keep a clear head, ignore the short-term noise and focus on your long-term objectives.

Time in the Market

Trying to time market highs and lows is impossible, no one has a crystal ball and can predict how markets will behave. Trying to time markets can see you missing out on the best days and potentially being caught by the worst days. The normal ups and downs of markets are natural, but impossible to predict.

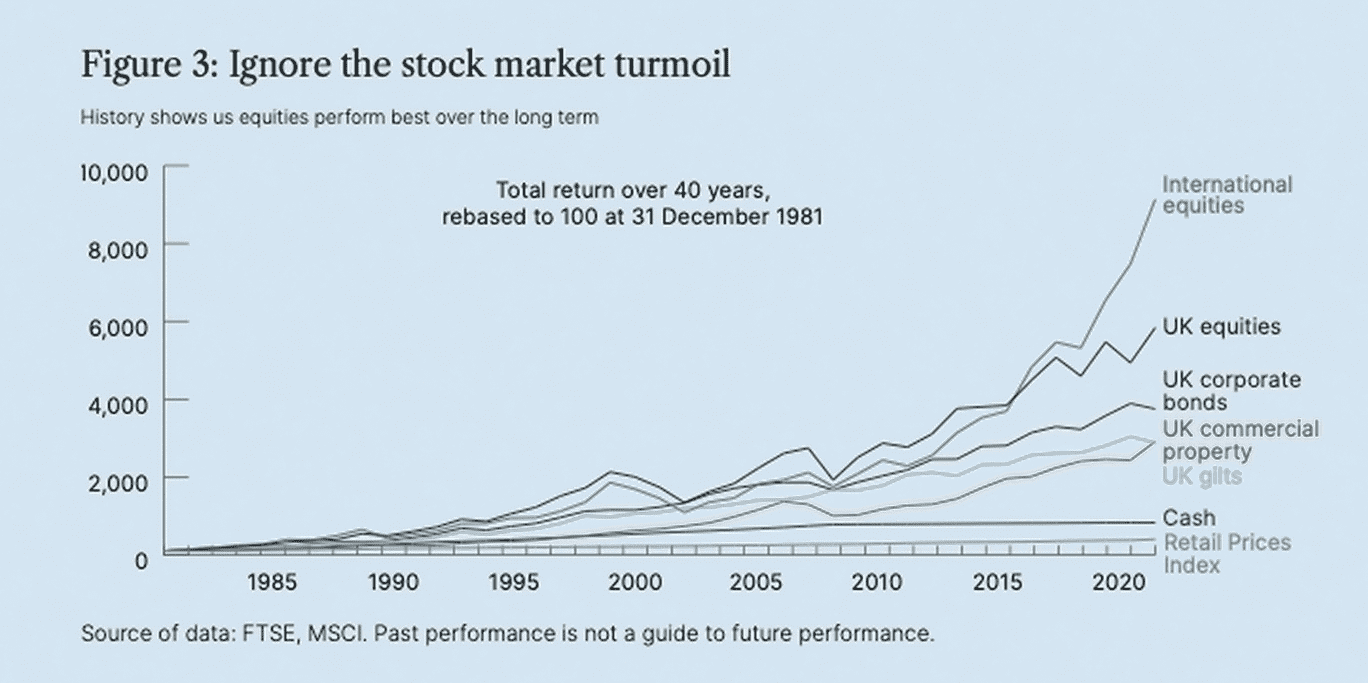

Investors who pull their money out of markets at the first sign of trouble could miss out on higher longer-term growth. Panic selling significantly reduces returns for longer term investors. Historical data shows that the time spent in the markets is far more beneficial than trying to time the market ups and downs. For example, if you invested £10,000 in global equities in January 1982, it would be worth £870,129 some 40 years later (Fig. 1.) However, if you missed the best 3 months out of that 40-year period your investment would be £621,964. By missing the best 2 years in that same 40-year period, it would be worth just £107,420.

Not only is it impossible to predict when the decline is coming, it is also impossible to predict when the rebound will occur. Selling down to cash when markets are volatile and then trying to re-enter the markets at the “right time” will severely compromise a portfolio’s value. It is almost always better to stay invested, even when it’s tough. Market highs usually follow the lows, selling when values are low means you will probably miss the recovery. Stay calm and avoid making any knee-jerk reactions.

Get Started Today

Book a Meeting

Wanting to know if you're on track to reach your financial goals? Book an appointment for a financial review today and find out what we can do for you.

Read about our advisors on our about page here.

Markets Always Recover

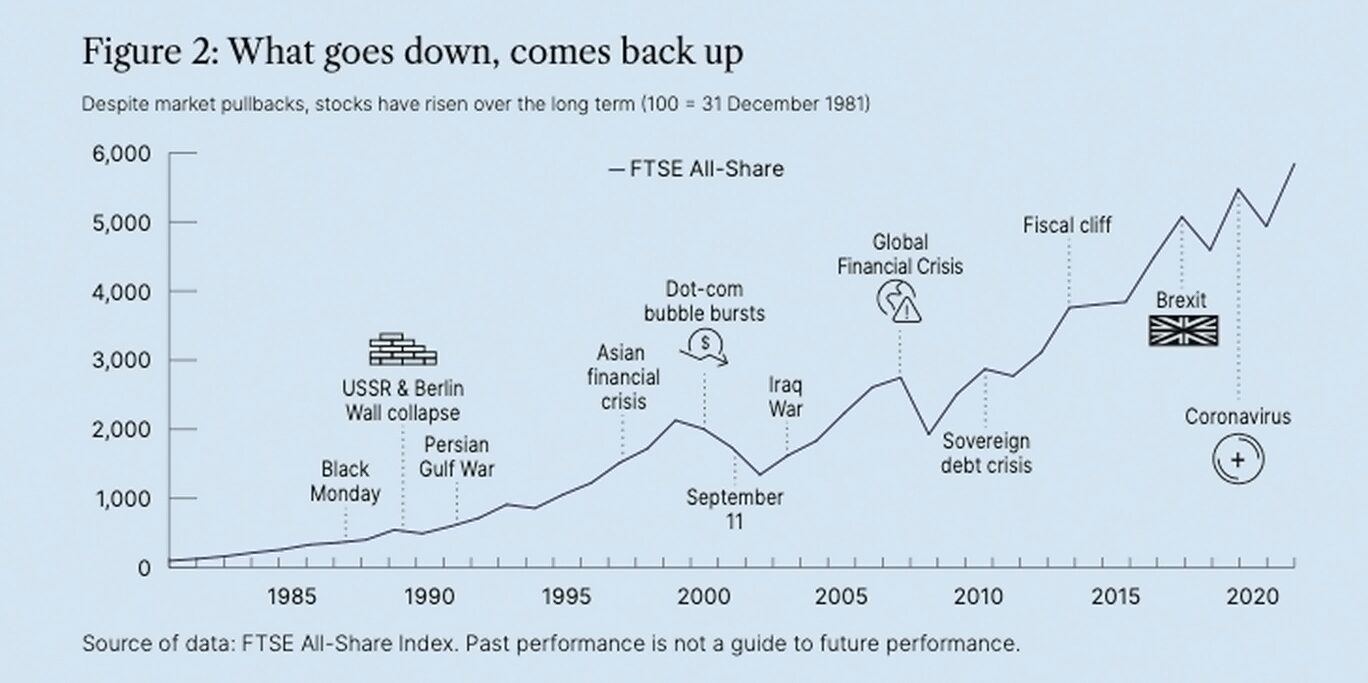

Decades of data show the markets falls and recoveries, it can take time for recovery to happen, which is why it is important to remain invested in tough conditions. Regardless of how bad crashes have been in the past, markets have bounced back and gone on to reach new highs (Fig. 2.)

Periods of market contraction (or Bear markets as they are referred to) are short lived lasting less than a year on average. Selling in market downturns to try and avoid further losses means you are likely to miss out on the recovery, as the biggest gains tend to happen right at the start of the recovery period. This is why ignoring the noise and your emotions is important so not to do long term damage to your investments. Short term volatility can actually create opportunities for long term growth.

Over the long term, history shows us that equities (stocks and shares) perform more strongly than any other asset class (Fig. 3.). So, if you can stay invested, you will be able to reap the benefits on the flip side. We are here to guide you through these uncertain times and to ensure that, long term, your portfolio is positioned to capture what the markets have to offer.

Time and patience are required when holding investments, as well as an ability to ignore your emotions. As experienced and knowledgeable financial advisors, we have seen all of this before many times over. We have access to a wealth of market data and hold regular investment committee meetings to review our own portfolios as well as the performance of funds in the wider market across different asset classes.

We make sure that your investment portfolios are diversified, in line with our client’s attitude to investment risk and have an element of active fund management, so that high quality stocks can be added at more reasonable valuations which will benefit returns and growth in the long term.

This year has been challenging for investors so far, but the data shows us that staying with an investment strategy that is built for your long-term objectives delivers the best results. The economy and businesses grow over time, so should your investment portfolio.

Markets will always rise and fall over the short term, so it is important to look beyond the headwinds and maintain a long-term view. This will ensure that you don’t miss out on the recovery and the best days in the markets giving your portfolio the best possible opportunity for growth.

This article was written by Craig Croft-Rayner, an independent financial advisor at Milestone Financial Planning. It is for information only and does not constitute financial advice. Past performance is not a guide to future returns.

Top Rated Financial Advisors